Starting a new business or a side hustle can be harder than it looks. Everyone has ideas, but not everyone can execute his or her strategy flawlessly. One of the first basic administrative tasks to do when founding a startup is to set up a business bank account in Singapore. Keeping your business transactions separate from personal ones is without a doubt one of the best practices for good financial management. Unfortunately, setting a corporate bank account was not exactly a seamless process – endless paperwork, demands for branch visits, ridiculously high fx rates, and fees – until Aspire came in… Aspire is the 1st business neobank in Singapore to offer a digital Business Account for SMEs, where all processes and features, including the onboarding process, are held entirely online on its platform.

Note: A neobank is similar to a bank, just that it operates exclusively online without the traditional physical branches. This translates to more convenience and cost savings for the end-user.

You should be able to guess that we have nothing but praise for the Aspire Business Account by now, so here’s why we are not sitting on the fence for this one!

You will only receive your promo/referral code bonus after you have signed up using our link and have made a purchase of at least S$50 of qualifying spend.

Aspire Promo Code: Get S$250 after your First Card Transaction

(spend min. S$50*)

One account for all your business financial needs.

100% digital and free opening, no hidden fees.

The promo/referral code will automatically be entered when you click “Open account”.

Alternatively, key in promo code YADHHU5R.

*Terms and conditions here.

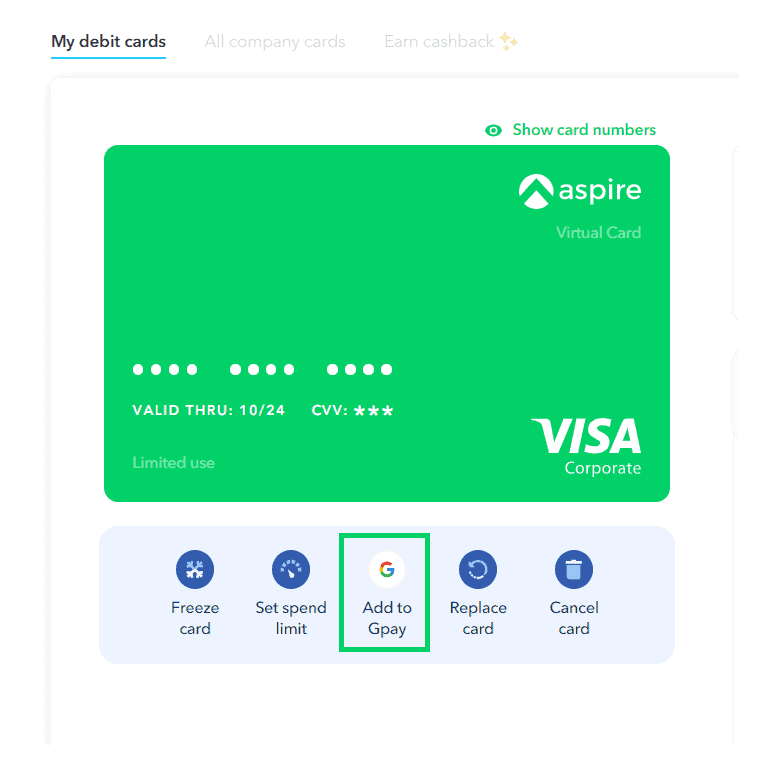

Not sure how to spend using a virtual card? It’s easy!

Simply enter the card details onto your Google Pay app or any other digital wallet platform and you can use it for all your physical and virtual transactions.

P.S. Google Pay has a sign-up bonus too if you don’t have an account yet. Read more about Google Pay here.

There is also a “Add to Gpay” button is available on the Aspire App and website, which contains a quick guide with screenshots on how to add your Aspire Card to Google Pay, courtesy of Aspire.

If you are experiencing difficulties and are very sure you completed all steps, please contact Aspire quoting our link/website.

Aspire’s Background

Aspire is Southeast Asia’s first business neobank to offer modern entrepreneurs and digital-savvy businesses with convenience and simplicity to manage their business within a single account.

Unlike traditional banks, you no longer need to queue physically, sign a ton of forms, and all the other niceties (such as waiting for an entire week for the inefficient approving officer to process your application) before finally opening a bank account.

Opening an account is free, can be done in 5 minutes, and has no minimum deposit. It is literally the fastest approval time / fastest account opening the Guidesify team has experienced.

Of course, the Aspire business account comes with a sleek design to top the great user experience off.

The account comes with a virtual debit card to offer cashback on digital marketing and SaaS spending. Other product offerings include the best-in-market FX rates and access to a credit line to grow your business.

Simply put, Aspire is your all-in-one service for SMEs, entrepreneurs, and side hustlers!

Perks of using Aspire as compared to traditional Singapore Banks

Going digital and starting an Aspire account brings a lot more to the table than just a fast and easy onboarding process.

Here’s a quick overview of Aspire vs some of the other alternative business bank accounts available in Singapore (extracted from Aspire’s comparison table):

| Aspire | Banks | Wise | Airwallex | Youbiz | |

|---|---|---|---|---|---|

| Account Fees | Free | No | S$54 One-Time Fee | Free | Free |

| Receive/Send via PayNow | Yes | Yes | No | No | No |

| Security of Funds | 100% safeguarded | Insured up to $75K | 100% safeguarded | 100% safeguarded | 100% safeguarded |

| Account Opening | Online | May require physical appointments | Online | Online | Online |

| Virtual Cards | Unlimited with no fees | No | 1 free per account, $4 per additional card | Unlimited | Unlimited |

| Card Cashback | 1% Cashback (on digital marketing & SaaS) | Up to 0.3% Cashback | No | 1% Cashback | 1% Cashback |

| Live Support | Yes | No | Yes | No | Yes |

It’s pretty safe to say that Aspire is far superior to any of the common business bank accounts and is way ahead in the game.

No more hefty fees and no more waiting on overcrowded customer hotlines -you can now focus on what truly matters in your business.

Interested in a more in-depth comparison across more Singapore bank accounts? You can request a comprehensive chart from Aspire here.

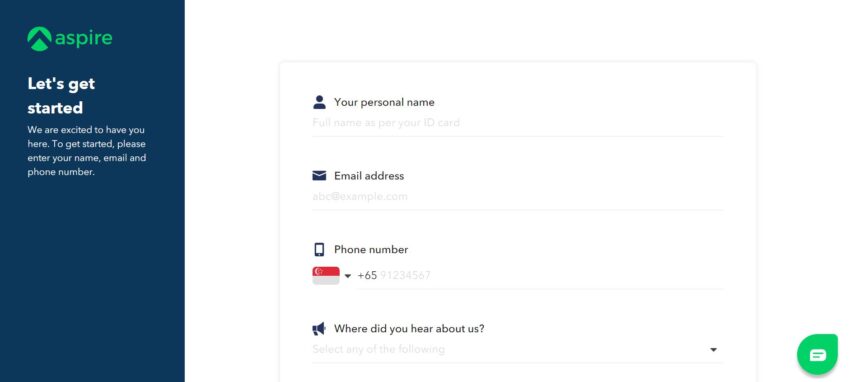

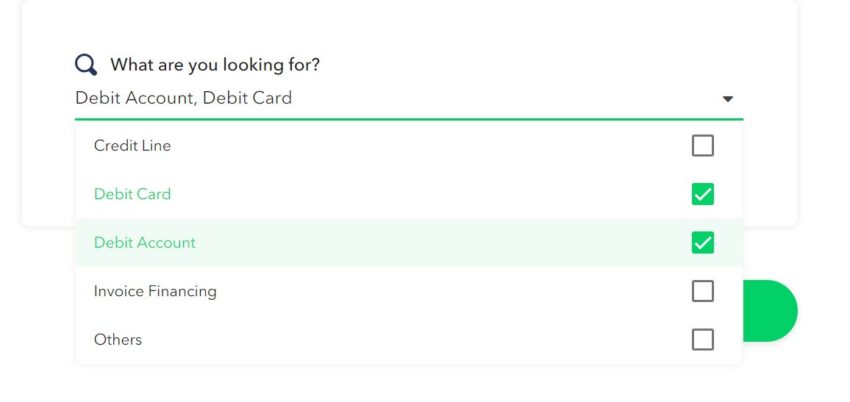

Walkthrough of the Online Account Opening Process

You will get your account verified in a matter of minutes.

Yep, you heard that right. Minutes when you sign up with MyInfo.

Even for foreign directors, the remote process is still fast and seamless.

Check out the few simple steps (that are tried and tested) you would need to undertake to sign up for the account. For now, only a director of the business can register for an Aspire account.

All that is required would be for you to choose the Aspire product you are looking for and review your application with the information retrieved from MyInfo.

Shortly after a few simple clicks, your information will be retrieved and sent for verification.

True enough, Guidesify got our account verified in a matter of minutes and honestly, it was pretty impressive.

Do note that it can take up to 24 hours to get verified if you choose the other option of submitting documents, instead of using MyInfo.

Aspire App Features

Aspire Card + 1% Cashback

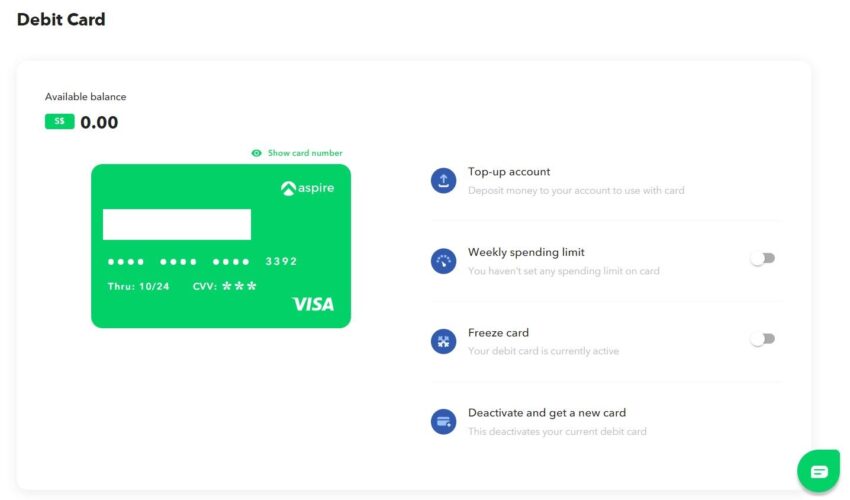

The Aspire Card is a completely free Visa Debit virtual card linked to your Aspire Business Account. This card can be used for any transaction that accepts Visa Debit as a payment method, Google Pay payments included!

Once your Aspire account is approved and opened, the virtual card is for you to spend.

So there’s no waiting for the card to be sent to you via snail mail before you start spending.

Cardholders will enjoy low fx fees when making international transactions, and 1% cashback on online marketing and SaaS spend. The cashback promotions apply when you make transactions with qualifying merchants, such as Facebook Ads, Google Ads, Shopify, AWS, Google Suite, and many more.

Don’t see your favourite merchants on the list? Simply nominate them to be one of the top 20 most requested merchants!

Power up your Aspire account with seamless integration options (Gpay, Xero, etc)

Yeah, there are many multi-currency/travel cards that offer the ability to integrate with your phone’s Tap and Pay feature.

But have you ever seen a business card do the same? Or better, is there a business card that tracks expenses digitally and automatically syncs with your business’s accounting platform?

No, not really, but there is now.

The Aspire card is one of the first business cards to be able to integrate effortlessly with Google Pay. Granted that there are alternatives that may offer such an option for business accounts too, let’s not forget that the said alternatives pale in comparison in terms of FX rates and a slow account approval and card issuance time (tbh nobody can beat 5 minutes to have everything set up for your business).

Since it is completely digital, there is no need to worry about messy papers.

Just remember to bring your phone out if you are purchasing at your local merchants’ stores.

Is that all?

No.

Aspire allows its users to integrate their transaction records automatically with Xero, which means no more extra work when spending and receiving money on the app.

Simply follow the six-step integration guide with Xero and users should see that their past transactions (up to 1 year) are automatically synced with Xero, as well as any future transactions on an hourly basis.

Aspire also supports Quickbooks, Netsuite, and all major accounting software available on the market.

Lowest FX Rates A Business Can Enjoy

Powered by Transferwise, Aspire Business Accounts offer the lowest FX fees in the market, up to 7x cheaper than most banks that can transact across 50+ currencies.

Here are some of the things you may enjoy:

- Free local transfers via USD-USD locally via ACH & SGD via FAST.

- Ability to receive and send funds via PayNow for free

- Best FX rates, up to 3x cheaper than banks, with 0 FX processing fees.

- For cross-border SWIFT transfers, only a flat $8 applies (one of the lowest in the market).

Multi-user Accounts? Sure, why not!

Without ever visiting a branch, you can easily add the rest of your team and set specific access permissions for each of your team members.

This means issuing unlimited virtual cards for your team, eradicating the well-known annoyance of sharing corporate cards, and hunting down mystery spend. With the help of Aspire’s transaction approval flows and bulk transfer features, the enhanced traceability greatly simplifies your work; all you have to do is approve.

Hooray to the hours saved on claims processing and say no to sharing OTPs.

Final Thoughts

Aspire Promo Code: Get S$250 after your First Card Transaction

(spend min. S$50*)

One account for all your business financial needs.

100% digital and free opening, no hidden fees.

The promo/referral code will automatically be entered when you click “Open account”.

Alternatively, key in promo code YADHHU5R.

You will only receive your promo/referral code bonus after you have signed up using our link and have made a purchase of at least S$50 of qualifying spend.

*Terms and conditions here.

Aspire has made business banking a lot easier yet more powerful. And we are hopeful for more as the team continues to strive for greatness and stay way ahead of its time.

Being an SME ourselves, it was truly a hassle to set up a coveted bank account for the company.

Our calls were redirected to different bank branches, applications were reverted several times and we still had to queue in line along with everyone else for hours just to open a bank account.

It got us thinking, is that how we really want to spend our time when running a business?

Hence, there was definitely a huge gap in this area until…of course when Aspire came into the picture.

Aside from the 5 minutes of your life, Aspire takes nothing from you when setting up an account.

Drawbacks

However, the Aspire business account currently does not allow users to register their UEN for PayNow, although this is subject to changes and PayNow seems to be on the Aspire’s roadmap/to-do list. Also, it can be a slight inconvenience too if your local merchants do not accept Google Pay at their stores.

Update as of June 2023: Aspire now allows users to both send and receive funds via PayNow, via all PayNow transfer methods for free, including Mobile, UEN, NRIC, QR code, and VPA.

We didn’t think that the absence of a chequebook is a downside to Aspire since cheques are pretty much a thing of the past. Stop using it and start embracing the future!

Think there are additional features Aspire should have?

It is also heartening to see and know that Aspire is a modern company that takes feedback seriously to continuously improve. Aspire has a closely monitored forum where you can give suggestions and from there, you can see the progress and reply to your suggestion.

Keep Aspiring!